If you’re looking for a simple yet powerful tool to estimate the time it takes for an investment to double, the Rule of 72 is your answer. This financial Rule is a quick and easy way to gain insight into the growth potential of your investments. In this article, we’ll break down the Rule of 72, explain how it works, and provide practical examples to help you make informed financial decisions.

Introduction to the Rule of 72

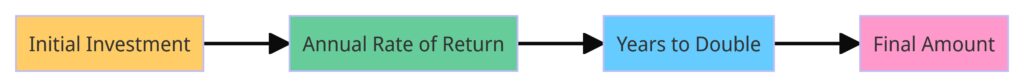

Imagine you’re considering an investment opportunity and want to know approximately how long it will take for your investment to double. The Rule of 72 provides a remarkably close estimate. This Rule states that by dividing 72 by the annual rate of return, you can determine the years it will take for your investment to double in value.

Understanding Compound Interest

To truly grasp the essence of the Rule of 72, it’s crucial to first delve into the concept of compound interest. This force of a financial nature allows the initial invested amount to earn interest rate and enables the accrued interest to further generate earnings. The compounding effect is the engine propelling investments to new heights over time. The Rule of 72 harnesses this principle to offer investors a quick, mental shortcut to project the potential growth trajectory of their investments.

Deriving the Rule of 72 Equation

The Rule of 72 is rooted in the mathematical principles of logarithms and exponential growth. The formula for the Rule of 72 is:

Years to Double = 72 / Annual Rate of Return

This formula applies to various scenarios, from investments to debt repayment. It’s important to note that the Rule provides an estimate rather than an exact calculation.

Using the Rule of 72 for Investments

Imagine you’re considering an investment opportunity with an anticipated annual return of 8%. By invoking the Rule of 72, you can swiftly ascertain that your investment will likely double in value in approximately nine years (72 / 8 = 9). This application proves particularly beneficial when comparing diverse investment prospects. Not only does it aid in decision-making, but it also empowers investors to set realistic expectations for their financial goals.

Limitations of the Rule of 72

While the Rule of seventy two is a valuable tool, it has limitations. It assumes a fixed annual rate of return, which might not reflect the actual fluctuations in the market. Additionally, the Rule becomes less accurate for higher interest rates.

Rule of 72 vs. Actual Calculations

Intriguingly, the Rule of 72 often outperforms expectations in its accuracy. For instance, with lower interest rates, the Rule tends to overestimate the time required for an investment to double, while at higher rates, it underestimates this timeframe. This inherent flexibility adds an extra layer of reliability to the Rule’s approximations.

Applying the Rule of 72 to Savings Goals

The Rule of 72 isn’t limited to investments; it’s also useful for setting savings goals. If you’re planning for a specific financial milestone, such as a down payment on a house, you can use the Rule to estimate how long it will take to save the required amount.

Making the Most of the Rule of 72

While the Rule of 72 is handy for quick estimates, combining it with other financial planning strategies is essential. Diversification, risk assessment, and long-term goals should all factor into your investment decisions.

Real-world Examples of the Rule of 72

Let’s explore real-world examples to see the Rule of 72 in action. Consider an investment with a 6% annual return. Applying the Rule, your investment would take around 12 years to double (72 / 6 = 12).

Rule of 72 in Financial Planning

Financial planners often utilize the Rule of 72 to provide clients with a straightforward visualization of their investment’s growth potential. This helps clients better understand the impact of different interest rates on their financial goals.

Calculating Risk and Returns

The Rule of 72 can also aid in assessing risk and potential returns. Higher rates of return indicate potentially riskier investments, while lower rates may offer more stability.

Importance of Consistency in Investments

Consistency is vital in maximizing the benefits of the Rule of 72. Regular contributions and reinvesting dividends can significantly impact the rate of growth.

Adjusting the Rule for Different Interest Rates

For greater accuracy with interest rates significantly above or below 72, you can adjust the Rule. Use 69 or 70 instead of 72 for slightly more precise estimates.

Exploring Alternatives to the Rule of 72

While the Rule of 72 is popular, alternatives like the Rule of 69 and the Rule of 115 exist. Each has its level of accuracy and application, so it’s worth exploring these options based on your specific needs.

Rule of 72: A Practical Tool for Investors

In conclusion, the Rule of 72 is a valuable tool that provides a quick and easy estimate of the time it takes for an investment to double. While it’s not a substitute for thorough financial planning, it offers a useful starting point for evaluating investment opportunities and setting savings goals.

Conclusion: Navigating the Investment Landscape

In closing, the Rule of 72 emerges as a remarkable asset in the investor’s toolkit. Its simplicity and respectable accuracy render it an invaluable resource for those seeking swift estimations of investment growth. While its simplicity might hint at limitations, its application within the broader context of financial planning underscores its significance. As you embark on your investment journey, remember that the Rule of 72 is not just a formula—it’s a guiding principle that empowers you to make informed financial decisions.

FAQs

Q1: Is the Rule of 72 accurate for all interest rates?

The Rule of 72 is more accurate for interest rates closer to 6% to 10%. Extreme interest rates may require adjustments.

Q2: Can I use the Rule of 72 for any currency?

Yes, the Rule of 72 can be used for any currency as long as the interest rate is consistent with the currency.

Q3: How can I apply the Rule of 72 to my retirement planning?

The Rule of 72 can help you estimate how long it will take for your retirement savings to double, assisting in setting achievable retirement goals.

Q4: What’s the main advantage of the Rule of 72?

The main advantage is its simplicity. It offers a quick estimate without the need for complex calculations.

Q5: Is the Rule of 72 applicable to short-term investments?

While the Rule can estimate short-term investments, it’s more effective for long-term investment planning.